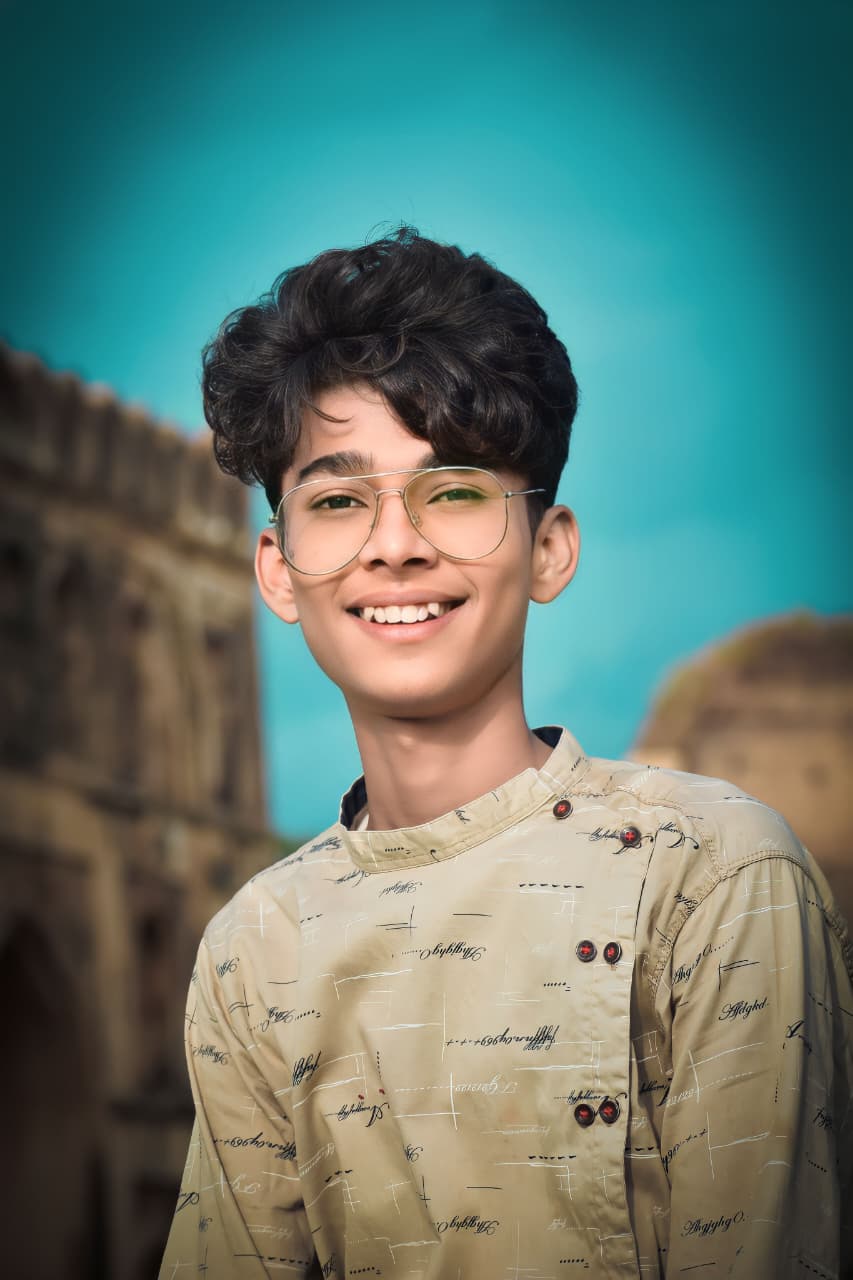

Muddu – Crypto Enthusiast & Analyst

Muddu has been actively involved in the crypto world for more than 3 years, closely tracking Bitcoin, altcoins, and emerging blockchain projects. With hands-on experience in crypto trading, market analysis, and following global regulations, he simplifies complex crypto trends into easy-to-understand insights for readers.

Through FastCryptoBuzz, Muddu aims to bring honest, research-driven, and timely crypto updates that help readers stay ahead in the fast-moving digital asset space. His mission is to make crypto knowledge accessible to everyone – from beginners to seasoned investors.

“Crypto is not just about coins, it’s about building the future of finance.” – Muddu