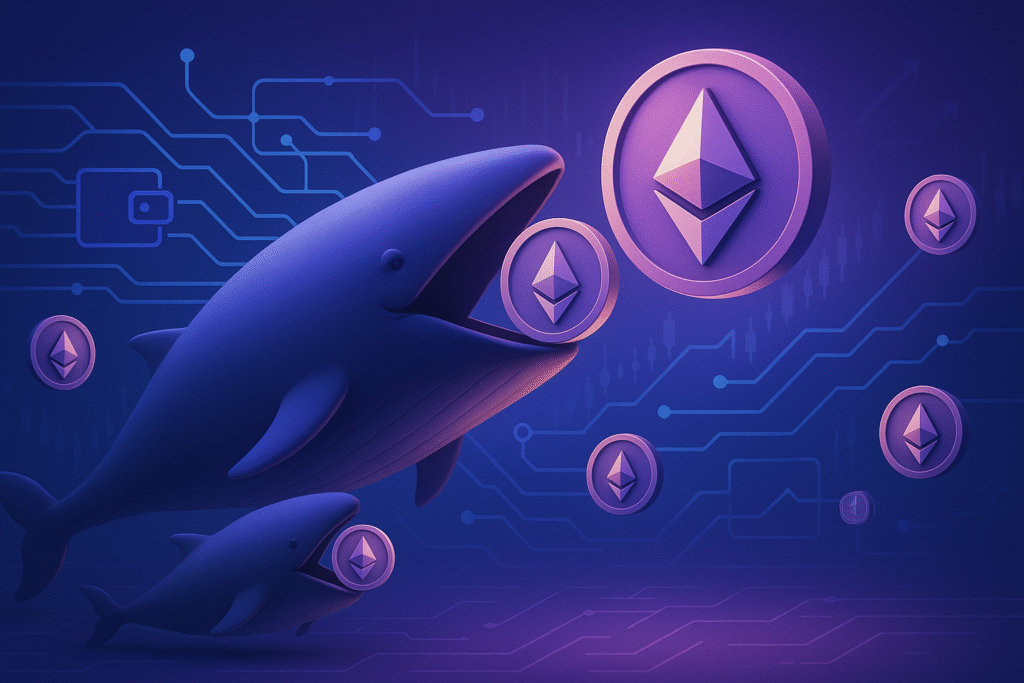

Recently, when the crypto market fell, something interesting happened.

Ethereum whales quietly bought more than 934,000 ETH.

This made a lot of people think again about what big players are planning. Many analysts say that when whales buy during a dip, it usually means they still trust the long-term future of ETH.

Prices are moving up and down, so traders want to understand if this buying can affect the next market cycle.

Below is a simple explanation of the Ethereum Whale Accumulation Bullish Signal.

Key Points

- Whales bought over 934K ETH when the market dropped.

- Big buying like this sometimes shows early bullish signs.

- ETH supply on exchanges is getting lower.

- Crypto is unpredictable, so nothing is guaranteed.

What This Whale Buying Actually Means

Whale accumulation basically means that very rich holders are buying a large amount of ETH.

On-chain data shows that during the recent dip, these big wallets added more than 934K ETH.

That is a huge amount.

It usually means they see value in Ethereum even when the price is falling.

Why This Is Important: The Ethereum Whale Accumulation Bullish Signal.

Whales mostly buy when others are scared.

And they sell when the market is too excited.

So when we see whales buying the dip, experts think:

- They believe ETH will grow in the future.

- They feel the price is low right now.

- They are preparing for long-term gains.

Retail traders also watch whales because they think whales have more information and better research teams.

Also read Upcoming Crypto Launches in December 2025.

How to stake Ethereum on a DeFi platform.

What’s Happening in the Market Now

Some other things happened at the same time:

- More ETH moved off exchanges into private wallets.

- Trading volume went high again.

- Gas fees dropped for a short time.

These things usually happen when the market is in an accumulation phase.

But again, nothing is certain in crypto.

What Experts Think Might Happen

Most experts don’t give exact predictions, but they say a few things:

- If whales keep holding, selling pressure can reduce

- Volatility may increase around big news.

- People will keep watching Ethereum upgrades and scaling changes.

History shows that whale buying sometimes leads to good price movement later.

But it doesn’t happen every time.

Check for more information on Ethereum.org—the official website

Why Everyone Is Talking About This

Whales often give early hints about where the market might go.

Long-Term Investors Are Paying Attention

People who hold ETH for the long term always track whale wallets.

Right now, the data clearly shows accumulation, so many investors feel positive about the Ethereum ecosystem.

ETH Supply on Exchanges Is Falling

Lower supply on exchanges usually means people are not planning to sell soon.

More ETH is going into staking or private wallets.

This sometimes:

- Shows confidence

- Reduces selling pressure

But price movement is still not guaranteed.

How This Information Helps Readers

This data helps readers understand how big players think during fear and dip periods.

Is This a Safe Signal?

There is no completely safe signal in crypto.

But whale actions help show:

- How the biggest investors react

- Whether the market is scared or confident

- What long-term players are expecting

Use this information only as part of your research.

What Could Happen in the Future

If we look at older market behavior, we may see:

- More volatility during accumulation

- Bigger reactions to ETH upgrades

- More discussions from analysts

Ethereum continues to grow through staking, L2 projects, and upgrades, and all of this affects whale movements.

How Whale Buying Might Affect the Market

Large accumulation sometimes:

- Reduces the ETH available for selling

- Adds buying pressure during dips

- Builds stronger confidence in the market

But every cycle is different.

Prices can change at any time.

My Personal Opinion

I personally feel this 934K ETH buying is not random at all.

Every time the market is scared, whales silently collect more.

Retail traders usually sell in panic, while whales do the opposite.

This moment looked exactly like that.

When ETH moves from exchanges to private wallets, it usually means a strong belief.

The Ethereum ecosystem has grown a lot—staking, L2 growth, and future upgrades—so whales don’t see dips as a bad thing.

For them, dips are discounts.

But one truth always remains the same:

Nothing is guaranteed in crypto.

News, sentiment, and global events can change prices anytime.

A bullish signal does not mean a 100% pump.

It only means confidence is improving.

“When whales sell, people worry.

When whales buy, it shows quiet confidence.”

Ethereum’s long-term path depends on adoption, upgrades, and overall market conditions.

But this 934K ETH accumulation clearly shows:

“Big players are still interested in Ethereum.”

FAQ

What is the Ethereum Whale Accumulation Bullish Signal?

It means large ETH holders buying during dips, which many see as long-term confidence.

Why did whales buy 934K ETH recently?

On-chain data shows they bought heavily during the dip, maybe because they felt ETH was undervalued.

Does whale buying always push the price up?

No. It can help, but many other things also affect the price.

Should traders follow whale activity?

It is useful to watch, but you should always do your own research.

Conclusion

The big 934K ETH purchase has attracted huge attention.

This level of buying often shows confidence from large investors.

But the crypto market is always uncertain.

This information helps readers understand how big players behave during dips and what they might be expecting in the long run on the Ethereum Whale Accumulation Bullish Signal.

Staying updated with on-chain data and news always helps.

Disclaimer

This article is only for information.

Crypto is volatile.

Always do your own research.

Muddu – Crypto Enthusiast & Analyst

Muddu has been actively involved in the crypto world for more than 3 years, closely tracking Bitcoin, altcoins, and emerging blockchain projects. With hands-on experience in crypto trading, market analysis, and following global regulations, he simplifies complex crypto trends into easy-to-understand insights for readers.

Through FastCryptoBuzz, Muddu aims to bring honest, research-driven, and timely crypto updates that help readers stay ahead in the fast-moving digital asset space. His mission is to make crypto knowledge accessible to everyone – from beginners to seasoned investors.

“Crypto is not just about coins, it’s about building the future of finance.” – Muddu