Earning passive income from crypto staking is no longer a buzzword limited to early crypto adopters. In 2026, it became one of the most practical ways for everyday investors to grow their crypto holdings without constant trading stress.

If you’re tired of watching price charts all day or losing sleep over market volatility, staking offers a calmer, more predictable approach. This guide breaks everything down step by step—no fluff, no unrealistic promises, just logic, clarity, and real-world usefulness. Don’t miss the article end.

What Crypto Staking Really Means

Crypto staking is the process of locking your cryptocurrency to help secure a blockchain network that uses a Proof-of-Stake (PoS) or similar consensus mechanism. In return, the network rewards you with additional tokens.

Also read PoS on Ethereum Official – Proof of Stake explanation

Think of it like this:

Instead of lending money to a bank, you’re supporting a blockchain’s operations—and the blockchain pays you interest.

Unlike mining, staking doesn’t require expensive hardware, noisy machines, or high electricity bills. That’s why it has grown massively in popularity by 2025 and continues to expand into 2026.

Why Staking Is Still Relevant and Safe in 2026

Crypto evolves fast, but staking has proven its durability. Major blockchains like Ethereum, Cardano, Solana, and Polkadot rely on staking as their core security model.

Key reasons staking remains relevant:

- Energy-efficient compared to mining

- Supported by top exchanges and wallets

- Increasing adoption by long-term investors

- More regulatory clarity than speculative trading in many regions

Staking isn’t about “getting rich overnight.” It’s about consistency—slow gains that compound over time.

Also read the similar post

How to start Crypto trading in 2026.

How to Stake Ethereum on a Defi Platform.

Types of Crypto Staking You Should Know

Exchange-Based Staking Beginner Friendly

Most beginners start here. Centralised platforms handle all the technical work, and you earn rewards automatically.

Pros: Easy setup, low effort

Cons: Platform custody risk, lower control

Wallet-Based Staking

You stake directly from a non-custodial wallet while keeping control of your private keys.

Pros: Higher security, more transparency

Cons: Slight learning curve

DeFi and Liquid Staking

Advanced users explore decentralised staking protocols that allow flexibility while earning rewards.

Pros: Liquidity, innovation

Cons: Smart contract risk

Step-by-Step Guide to Start Crypto Staking in 2026

Step 1: Choose a Reliable Staking Coin

Not every cryptocurrency supports staking. Look for established projects with active development and real network usage.

Popular staking assets often share these traits:

- Strong validator participation

- Clear tokenomics

- Long-term roadmap

Avoid staking coins solely because of high advertised returns. Sustainability matters more than percentage numbers.

Step 2: Decide Where You Want to Stake

Your choice depends on experience and comfort level.

- Beginners: Start with a reputable exchange

- Intermediate users: Use official wallets

- Advanced users: Explore DeFi protocols

Always enable security features like two-factor authentication and backup recovery phrases properly.

Step 3: Understand Lock-Up Periods and Rules

Some staking models require you to lock funds for a specific period. Others allow flexible withdrawal with short waiting times.

Before staking, check:

- Minimum staking amount

- Lock-in duration

- Unstaking delay

Patience is part of passive income. If you may need quick liquidity, flexible staking suits you better.

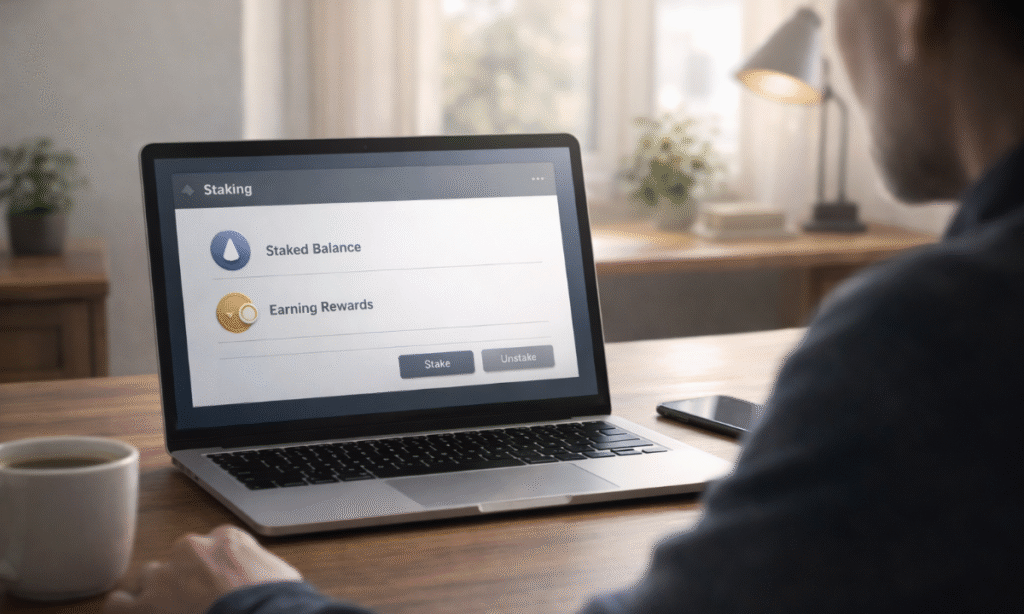

Step 4: Start Staking and Monitor Rewards

Once you stake, rewards accumulate based on network rules and validator performance. You don’t need to check them every hour—weekly monitoring is more than enough.

How rewards are usually distributed:

- Daily

- Weekly

- Epoch-based (network-specific cycles)

Compounding rewards by re-staking them can significantly boost long-term returns.

How Much Can You Earn From Crypto Staking?

Returns vary depending on the blockchain, network demand, and staking participation.

Instead of chasing numbers, focus on:

- Consistency

- Network reliability

- Token utility

Staking works best when combined with a long-term holding mindset. Short-term expectations often lead to disappointment.

Risks Involved in Crypto Staking Be Honest With Yourself

Market Volatility

Rewards may grow, but token prices can fall. Staking doesn’t eliminate price risk—it complements long-term belief.

Validator or Platform Risk

Poor validator performance can reduce rewards. That’s why choosing reputable validators or platforms matters.

Smart Contract Risk

In DeFi staking, bugs or exploits remain a reality. Use well-audited protocols only.

Risk doesn’t mean danger—it means awareness.

Taxation and Legal Awareness in 2026

In many regions, staking rewards are treated as taxable income. Rules vary by country and can change over time.

Best practices:

- Track reward history

- Keep transaction records

- Consult a local tax professional.

Ignoring taxes today often creates bigger problems tomorrow.

Smart Strategies to Maximise Staking Income

- Diversify across multiple staking assets.

- Reinvest rewards periodically

- Avoid “too good to be true” APYs

- Stay updated with protocol changes.

A calm strategy usually beats aggressive experimentation.

Common Mistakes New Stakers Should Avoid

- Staking without understanding lock-up rules

- Ignoring platform security

- Over-concentrating in one coin

- Expecting guaranteed profits

Staking rewards discipline, not impatience.

My Honest Opinion As a Crypto Journalist With Real Market Experience

As a crypto journalist who has closely tracked the market through multiple cycles, regulations, hype waves, and crashes, my honest opinion is this: earning passive income from crypto staking is one of the most realistic and sustainable crypto use-cases going into 2026—but only if people approach it with maturity, not greed.

Most newcomers make the mistake of treating staking like a fixed deposit or a guaranteed return product. It is not. Staking works best when you already believe in the long-term value of a blockchain. If the project survives, grows, and stays relevant, staking quietly rewards patience. If the project fails, no APY can save you. That’s the truth many influencers avoid saying.

What I personally respect about staking is that it aligns incentives properly. You’re not just chasing price; you’re participating in network security and decentralisation. In a market often driven by noise, staking brings discipline. It encourages long-term thinking in an industry that desperately needs it.

However, I also believe staking is not for people who want fast money. If someone checks rewards every hour or panics during minor price dips, staking will feel disappointing. But for investors who value consistency, low stress, and gradual growth, staking can become a core pillar of a responsible crypto strategy in 2026 and beyond.

In short, staking won’t make headlines—but it will quietly reward those who understand patience. And in crypto, patience is still one of the most undervalued skills.

FAQs – Crypto Staking Explained

Is crypto staking safe for beginners in 2026?

Yes, if you use reputable platforms and understand basic rules. Start small and learn gradually.

Can I lose my staked crypto?

You can face losses due to market price drops or platform issues, but proper research reduces risks significantly.

How often do staking rewards pay out?

This depends on the blockchain—some pay daily, others per network cycle.

Do I need technical knowledge to stake crypto?

Basic understanding is enough. Advanced setups are optional, not mandatory.

Is staking better than crypto trading?

They serve different purposes. Staking suits long-term, low-stress investors, while trading requires constant attention.

Final Thoughts: Is Crypto Staking Worth It in 2026?

Crypto staking isn’t a shortcut to wealth—but it is a realistic path to passive income when done responsibly. It rewards patience, consistency, and understanding rather than luck.

If you believe in the long-term future of blockchain technology, staking allows your crypto to work quietly in the background while you focus on life.

And honestly? That peace of mind itself is a reward.

Disclaimer

The information shared in this article is based on research, publicly available data, and real-world observations of the cryptocurrency market. It is intended strictly for educational and informational purposes. I am not a financial advisor, and this content should not be considered financial, investment, or legal advice. Cryptocurrency investments and staking involve market risk, price volatility, and regulatory uncertainty. Readers are advised to do their own research and consult a qualified financial professional before making any investment decisions.

Muddu – Crypto Enthusiast & Analyst

Muddu has been actively involved in the crypto world for more than 3 years, closely tracking Bitcoin, altcoins, and emerging blockchain projects. With hands-on experience in crypto trading, market analysis, and following global regulations, he simplifies complex crypto trends into easy-to-understand insights for readers.

Through FastCryptoBuzz, Muddu aims to bring honest, research-driven, and timely crypto updates that help readers stay ahead in the fast-moving digital asset space. His mission is to make crypto knowledge accessible to everyone – from beginners to seasoned investors.

“Crypto is not just about coins, it’s about building the future of finance.” – Muddu