Cryptocurrency trading sounds exciting, but for beginners, it often feels confusing, risky, and overwhelming. By 2026, crypto will no longer be a “new thing.” It has matured into a serious financial market where informed people grow steadily, and uninformed people lose money fast.

Most beginners fail not because crypto trading is impossible, but because they start without understanding how the system actually works. They chase quick profits, follow random tips, and ignore risk. This guide exists to fix that problem.

If you are a beginner and genuinely want to understand how to start crypto trading for beginners in 2026—step by step, safely, and realistically

Also, read the similar post.

How to keep your wallet safe on your phone

How to stake Ethereum on a Defi platform.

What Crypto Trading Really Means

Cryptocurrency trading is the act of buying and selling digital assets to benefit from price movements. Unlike long-term investing, trading focuses on timing, discipline, and decision-making.

Crypto markets run 24/7. Prices react instantly to global news, regulations, technology upgrades, and market sentiment. This speed attracts beginners, but it also punishes emotional decisions.

Here is the truth most people don’t say clearly:

Crypto trading is not gambling, but it becomes gambling if you trade without rules.

In 2026, crypto trading rewards people who think logically, manage risk, and stay patient. It destroys those who chase excitement.

How Crypto Trading Works in Simple Language

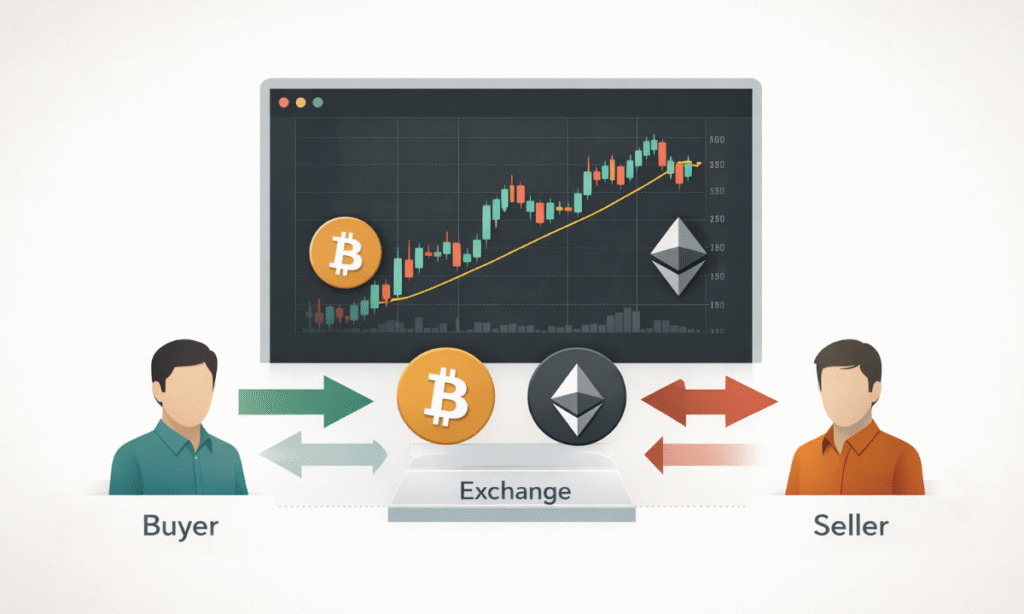

At its core, crypto trading happens on exchanges. These are platforms where buyers and sellers meet digitally.

When you buy a cryptocurrency:

- You are purchasing it from another trader.

- The price is decided by supply and demand.

- Your profit or loss depends on when you sell

Prices move because of:

- Market demand changes

- News and regulatory updates

- Large investors entering or exiting.

- Fear and greed cycles

You don’t need complex math to trade crypto. You need clarity, control, and consistency.

Choosing a Safe and Reliable Crypto Exchange in 2026

Your trading journey starts with choosing the right exchange. This decision matters more than beginners realise.

A good crypto exchange in 2026 should offer:

- Strong security (two-factor authentication, withdrawal protection)

- High liquidity for smooth trades

- Clear fee structure

- Regulatory compliance

- Simple interface for beginners

Avoid exchanges that promise guaranteed profits or unrealistic returns. Legitimate platforms never promise profits. They provide tools, not miracles.

Security comes first. Convenience comes second.

How to Set Up Your Trading Account the Right Way

Once you select an exchange, setup is not just about signing up—it is about protection.

You must:

- Use a strong, unique password.

- Enable two-factor authentication immediately.

- Secure your email account.

- Complete verification honestly

Never trade from public Wi-Fi. Never share screenshots of balances. Small habits prevent big losses in crypto.

In crypto, you are your own bank. Responsibility is non-negotiable.

How Much Money Do You Need to Start Crypto Trading in 2026?

This is one of the biggest beginner doubts—and also one of the biggest misconceptions.

You do not need a large amount of money to start crypto trading. What you need is the right mindset.

Beginners can start with:

- ₹500–₹1,000 for learning and understanding market behaviour

- ₹5,000–₹10,000 for practising real strategies with controlled risk

Small capital is not a disadvantage. It protects you from emotional damage while you learn. Large capital without experience increases mistakes.

In 2026, smart traders scale capital gradually. They don’t rush. They grow with skill, not hope.

Different Types of Crypto Trading Beginners Should Know

Not all crypto trading styles are beginner-friendly.

Spot Trading

You buy a cryptocurrency and own it directly. No leverage. No borrowing. Lower stress.

Futures and Margin Trading

These involve leverage, which multiplies both profits and losses. Beginners lose accounts quickly here.

For beginners in 2026, spot trading remains the safest learning ground.

Learn control before complexity.

Best Crypto Trading for Beginners in 2026

Instead of chasing “top coin lists,” beginners should focus on logic.

A beginner-friendly cryptocurrency usually has:

- High liquidity

- Stable trading volume

- Availability on major exchanges

- Lower manipulation risk

Bitcoin and Ethereum remain ideal for learning market structure. They move more slowly, but they teach patience and trend behaviour.

Meme coins may look attractive, but they are driven by emotion, not structure. Beginners often confuse luck with skill here—and pay later.

In crypto trading, boring is often safer than exciting.

Learning Basic Market Concepts Without Overloading Yourself

You don’t need to learn everything at once.

Focus on:

- Support and resistance levels

- Trend direction

- Volume behavior

Avoid filling charts with indicators. Clean charts improve decision-making.

Understanding price behavior matters more than fancy tools.

Risk Management: The Skill That Keeps You Alive in Crypto

Risk management is what separates traders from gamblers.

Golden rules beginners must follow:

- Never risk more than 1–2% of capital per trade.

- Always decide to exit before entry.

- Use stop-loss orders

- Accept losses as part of the game.

A trader who avoids big losses eventually learns to win. A trader who ignores risk disappears.

A Realistic Beginner Trading Example

Imagine a beginner in 2026 with ₹5,000 capital.

They choose spot trading.

They risk only 2% per trade (~₹100).

They set a stop-loss before entering.

First trade hits stop-loss. Loss accepted.

The second trade gives a small profit.

The net result is small, but confidence increases.

No screenshots. No luxury lifestyle. Just progress.

This is how real trading looks.

How Crypto Trading Is Changing in 2026

Crypto trading in 2026 is more mature than before.

Important changes beginners must understand:

- Regulations are clearer

- Exchanges enforce stronger compliance.

- Scams are more sophisticated.

- AI tools exist, but require knowledge.

Automation without understanding leads to faster losses. Manual learning still matters.

Crypto is becoming a serious financial skill, not a shortcut.

Common Beginner Mistakes You Must Avoid

Most beginner losses come from:

- Overtrading

- Following social media tips blindly

- Ignoring stop-losses

- Changing strategies too often

- Expecting fast results

Mistakes are part of learning—but repeating them is optional.

Security Practices Every Beginner Must Follow

Crypto security is your responsibility.

Follow these habits:

- Use trusted wallets

- Double-check addresses

- Avoid unknown links

- Stay away from fake giveaways.

In crypto, there are no refunds. Prevention is the only protection.

Taxes and Legal Awareness for Crypto Traders

By 2026, crypto taxation will be clearer in many regions.

You should:

- Track your trades

- Understand local tax rules.

- Report earnings honestly

Ignoring taxes creates future problems bigger than trading losses.

My Honest Opinion

If I share my honest opinion about crypto trading, without hype or drama, one thing is clear — crypto trading is not easy, but it is not impossible either.

Most people don’t fail in crypto because the market is bad. They fail because they enter with the wrong expectations. Many think they will make profits in the first month, gain confidence from the first trade, and quickly change their life. The reality is very different.

Crypto trading is a skill, and like any skill, it takes time to develop. Just like joining a gym doesn’t give results in the first week, trading also has a learning phase. The first few months are mainly about learning, not earning. Those who accept this phase are the ones who survive long-term.

I have noticed that beginners focus too much on profit, while they should first learn how to handle losses. Profit will come and go, but if losses break you emotionally, trading ends there. That’s why I believe building discipline is more important than making money at the start.

Another thing I strongly believe is that there are no shortcuts in crypto trading. Telegram tips, Twitter hype, and “guaranteed signals” usually lead to disappointment. Traders who build their own strategy and learn from their mistakes are the ones who earn respect from the market over time.

The crypto market in 2026 still has opportunities, but only for people with a realistic mindset. This market has matured. It no longer rewards excitement; it rewards patience, logic, and consistency.

Honestly, crypto trading is not for everyone — and accepting this is important. If you cannot control your emotions, follow discipline, or accept losses, crypto will give you stress, not freedom. But if you are ready to learn slowly and stay consistent, this skill can make you financially smarter.

My clear belief is that the goal of crypto trading should not be to get rich overnight. The real goal should be to stay calm in every situation — whether the market pumps or dumps. When your mindset becomes strong, profits naturally follow.

And one last thing I always say — the crypto market is not your enemy. Your biggest enemies are impatience and overconfidence. If you can control these two, crypto trading will never disappoint you.

FAQs

Is crypto trading safe for beginners in 2026?

Yes, if you use trusted platforms, manage risk, and avoid unrealistic expectations.

How much money should beginners start with?

Start with an amount you can afford to lose comfortably. Learning matters more than capital.

Can crypto trading be done part-time?

Yes. Many successful traders start part-time while learning.

Do beginners need advanced tools?

No. Simple charts and discipline matter more.

Final Thoughts

Crypto trading is not about speed. It is about survival and consistency.

Start small. Learn slowly. Protect capital.

That is how beginners turn into traders.

Disclaimer

This article is for educational and informational purposes only. Cryptocurrency trading involves risk, and prices can be highly volatile. Always do your own research and consider your financial situation before making any investment or trading decisions. The author and website are not responsible for any financial losses.

Muddu – Crypto Enthusiast & Analyst

Muddu has been actively involved in the crypto world for more than 3 years, closely tracking Bitcoin, altcoins, and emerging blockchain projects. With hands-on experience in crypto trading, market analysis, and following global regulations, he simplifies complex crypto trends into easy-to-understand insights for readers.

Through FastCryptoBuzz, Muddu aims to bring honest, research-driven, and timely crypto updates that help readers stay ahead in the fast-moving digital asset space. His mission is to make crypto knowledge accessible to everyone – from beginners to seasoned investors.

“Crypto is not just about coins, it’s about building the future of finance.” – Muddu