Cryptocurrency trading has moved far beyond a niche hobby. In 2026, crypto is mainstream — people trade Bitcoin, hold altcoins, earn staking rewards, and even receive payments in digital assets. But one question still scares beginners more than market crashes: crypto taxes.

If you are new to crypto or still confused about how taxes work, you are not alone. Most beginners don’t fail because of bad trades — they fail because they don’t understand tax rules properly.

This crypto tax guide for beginners in 2026 is written to solve that exact problem. No hype, no complicated language, no copied information. Just a clear, human explanation of how crypto taxes work, how to track your trades, and how to report them correctly without stress.

Why Crypto Taxes Matter More Than Ever in 2026

Earlier, crypto lived in a grey area. Many traders believed that small profits didn’t matter or that crypto was “untraceable.” That thinking no longer works.

In 2025, governments across the world actively monitor crypto activity. Exchanges follow strict reporting rules, and tax authorities expect honest disclosure. If you trade crypto and ignore taxes, you are not being smart — you are taking unnecessary risk.

Crypto taxes matter because:

- Profits from crypto are considered taxable income.

- Transactions leave a digital trail.

- Penalties for non-reporting can be serious.

- Proper reporting protects you legally and financially.

Understanding taxes is now a basic survival skill for every crypto trader.

How Crypto Is Taxed: Simple Explanation for Beginners

Crypto taxation may sound complex, but the core idea is simple. Tax applies when value changes hands.

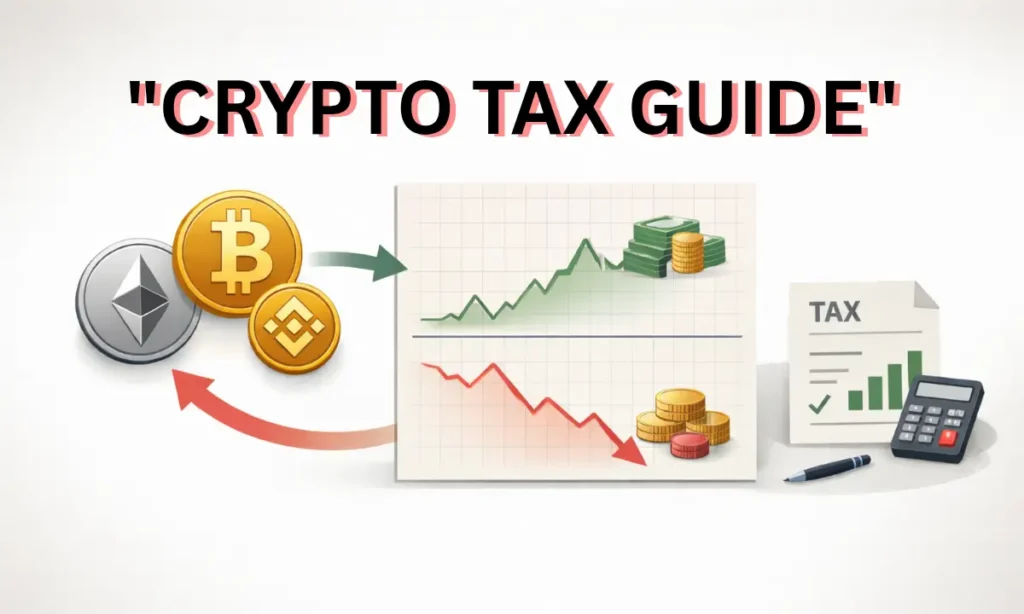

Capital Gains From Crypto Trades

Whenever you sell crypto, trade one coin for another, or use crypto to buy something, you create a taxable event.

The basic formula is straightforward:

Profit or Loss = Selling Price − Buying Price

If the result is positive, you pay tax on the gain. If it is negative, it is a loss.

In many regions, holding duration matters:

- Short-term holdings are taxed like normal income.

- Long-term holdings may receive lower tax rates.

The longer you hold, the better the tax treatment usually becomes.

Crypto Income Is Taxed Differently

Crypto is not only about trading. Many people earn crypto through:

- Staking

- Mining

- Airdrops

- Referral rewards

- Freelance payments

In these cases, crypto is treated as income, not capital gains. The value of the crypto at the time you receive it becomes taxable income.

Later, if you sell that crypto, capital gains tax may apply again. Yes, crypto can be taxed twice — welcome to reality.

Also, read a similar post

How to Start Crypto Trading in 2026.

How to stake Ethereum safely on a Defi Platform.

What Counts as a Taxable Crypto Event

Beginners often assume that only selling crypto creates tax. That is incorrect.

Taxable crypto events usually include:

- Selling crypto for fiat

- Trading one cryptocurrency for another

- Using crypto to purchase goods or services

- Receiving crypto as income or rewards

Non-taxable events usually include:

- Buying crypto with fiat

- Transferring crypto between your own wallets

- Holding crypto without selling

Understanding this difference prevents costly mistakes.

How to Track Crypto Trades Properly

Tracking is the backbone of crypto tax reporting. Without proper records, even honest traders can make errors.

What Information You Must Track

For every crypto transaction, you should record:

- Date and time

- Asset name

- Quantity

- Buy or sell price

- Fees paid

- Platform or wallet used

Missing even one of these details can create confusion later.

Why Manual Tracking Is Risky

Many beginners try to track trades using spreadsheets. This works only if:

- You have very few transactions.

- You are extremely organised.

Once trades increase, manual tracking leads to errors. Automated tracking tools reduce mistakes and save time. They also help calculate profits correctly using accepted accounting methods.

Tracking is not optional — it is essential.

How to Report Crypto Taxes Step by Step

Once tracking is complete, reporting becomes much easier.

Step 1: Calculate Gains, Losses, and Income

Separate your crypto activity into:

- Capital gains and losses

- Crypto income

This separation matters because they are reported differently.

Step 2: Declare All Transactions Honestly

Do not hide small trades or ignore losses. Partial reporting raises red flags. Honest, complete reporting builds long-term safety.

Step 3: Use the Correct Tax Forms

Most tax systems now include specific sections for digital assets. Fill them carefully and double-check figures.

If your crypto activity is complex, professional help is a smart investment, not a weakness.

Also, read the full information on India Crypto Tax Rules

Crypto Tax Rules in 2025: What Beginners Should Know

Crypto tax rules differ by country, but some trends are common globally in 2025:

- Crypto is legally recognised as a taxable asset.

- Exchanges cooperate with authorities.

- Reporting requirements are stricter.

- Penalties for non-compliance are clearer.

Some countries tax crypto profits heavily, while others offer relief for long-term holders. Knowing your local rules is crucial.

Never assume rules from social media posts. Always rely on official guidelines or professional advice.

Common Crypto Tax Mistakes Beginners Must Avoid

Most tax problems happen because of simple mistakes.

Ignoring Small Trades

Even small profits matter. Tax authorities do not ignore them.

Forgetting Crypto Income

Staking rewards and airdrops are often forgotten. That mistake can cause serious issues later.

Mixing Personal and Business Activity

If you trade frequently or earn crypto professionally, keep records separate. Mixing everything creates confusion.

Waiting Until Tax Deadline

Tracking and reporting should happen throughout the year, not at the last moment.

A Simple Real-Life Example

Imagine this situation:

You buy crypto worth $5,000.

Later, you sell it for $8,000.

Your taxable profit is $3,000.

Now imagine you made ten similar trades across the year. Without proper tracking, remembering exact prices becomes impossible. With tracking, reporting is straightforward.

Crypto taxes are not scary — lack of organisation is.

How to Prepare for Crypto Taxes in Advance

The smartest traders plan taxes before profits arrive.

Good habits include:

- Tracking trades monthly

- Keeping backups of records

- Reviewing tax impact before selling

- Setting aside funds for tax payments

This approach turns tax season from panic into routine.

My Personal Opinion

From my real experience observing beginners in crypto over the last few years, I can say this with confidence: crypto taxes are not the problem — lack of discipline is.

Most beginners lose money or get into trouble not because tax rules are unfair, but because they enter crypto without a system. They trade emotionally, don’t track transactions properly, and postpone tax responsibility until the last moment. When tax season arrives, confusion turns into panic.

In my view, treating crypto like a serious financial activity changes everything. The moment you start tracking trades, understanding taxable events, and planning ahead, crypto stops feeling risky and starts feeling structured. Taxes then become predictable, not scary.

I also believe that governments will continue tightening crypto regulations in 2025 and 2026. This does not mean crypto is dying. It means crypto is growing up. Markets that mature always demand accountability, and taxes are part of that maturity.

For beginners, my honest advice is simple: don’t chase shortcuts. Focus on learning, stay transparent, and respect tax rules from day one. In the long run, the traders who survive are not the ones who avoid taxes, but the ones who manage them smartly.

Crypto rewards patience, clarity, and responsibility — not shortcuts.

FAQs: Crypto Tax Guide for Beginners in 2025

Do I pay tax when I buy crypto?

No. Buying crypto is not taxable. Tax applies when you sell, trade, or earn crypto.

Are crypto losses useful for tax purposes?

In some regions, losses can reduce taxable gains. In others, restrictions apply. Check local rules carefully.

Is holding crypto taxable?

No. Simply holding crypto does not trigger tax.

Do I need to report crypto if I made no profit?

Yes. Some tax systems require disclosure even if there is no profit.

Should beginners consult a tax expert?

If your activity is more than basic buying and selling, professional guidance can save money and stress.

Final Thoughts: Crypto Taxes Are Part of the Game

Crypto trading is exciting, but taxes are part of the responsibility. Ignoring them does not make them disappear — it only creates problems later.

This crypto tax guide for beginners in 2025 was written to give you clarity, not fear. With proper tracking, honest reporting, and basic awareness, crypto taxes become manageable.

The market will keep changing in 2026 and beyond. Staying informed and disciplined will always put you ahead of the crowd.

Muddu – Crypto Enthusiast & Analyst

Muddu has been actively involved in the crypto world for more than 3 years, closely tracking Bitcoin, altcoins, and emerging blockchain projects. With hands-on experience in crypto trading, market analysis, and following global regulations, he simplifies complex crypto trends into easy-to-understand insights for readers.

Through FastCryptoBuzz, Muddu aims to bring honest, research-driven, and timely crypto updates that help readers stay ahead in the fast-moving digital asset space. His mission is to make crypto knowledge accessible to everyone – from beginners to seasoned investors.

“Crypto is not just about coins, it’s about building the future of finance.” – Muddu