Bitcoin investors woke up on December 16 with a familiar feeling — confusion, panic, and a lot of red on their screens. The crypto market does this often, but this drop felt different. Many traders asked the same question: why did the market suddenly turn bearish when nothing “major” seemed wrong?

To understand why Bitcoin crashed on December 16, we need to look beyond price charts. Bitcoin does not move randomly. It reacts to liquidity, macro events, trader psychology, and global money flow. Let’s break everything down calmly, logically, and honestly — without hype.

What Happened to Bitcoin Crashed on December 16?

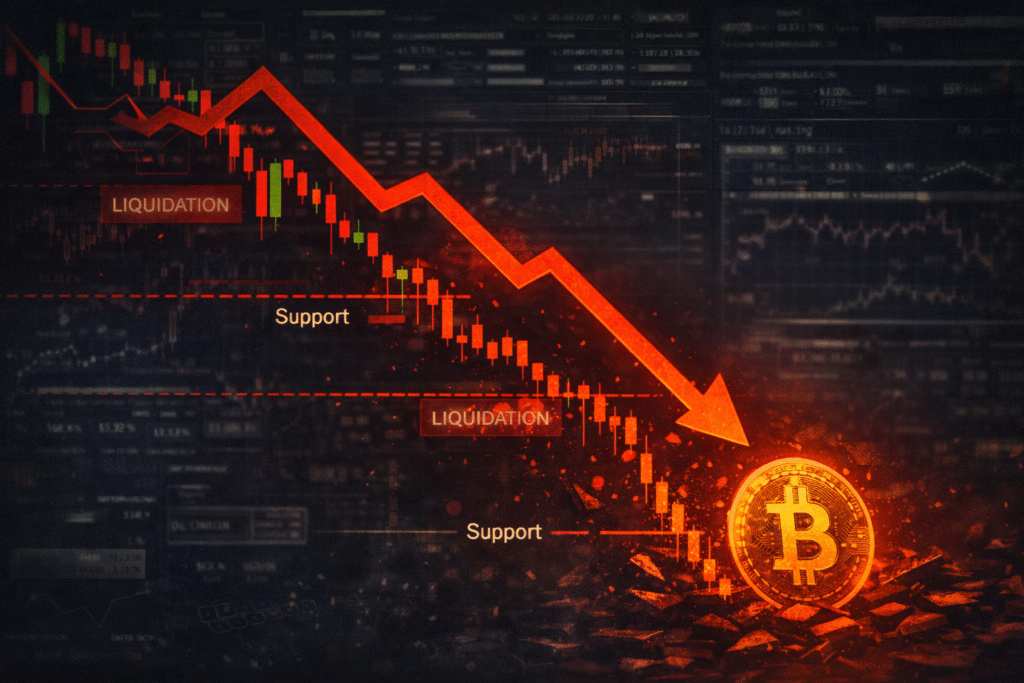

Bitcoin saw a sharp intraday drop on December 16, triggering liquidations across major exchanges. Long positions suffered the most, especially from over-leveraged traders who expected continuation of the previous uptrend.

This was not a “Bitcoin is dead” moment. It was a market structure correction, driven by a combination of macro pressure, profit booking, and leverage imbalance.

The crypto market works like a pressure cooker. When pressure builds too fast, it releases suddenly.

You can see the live price of BTC on CoinMarketCap.

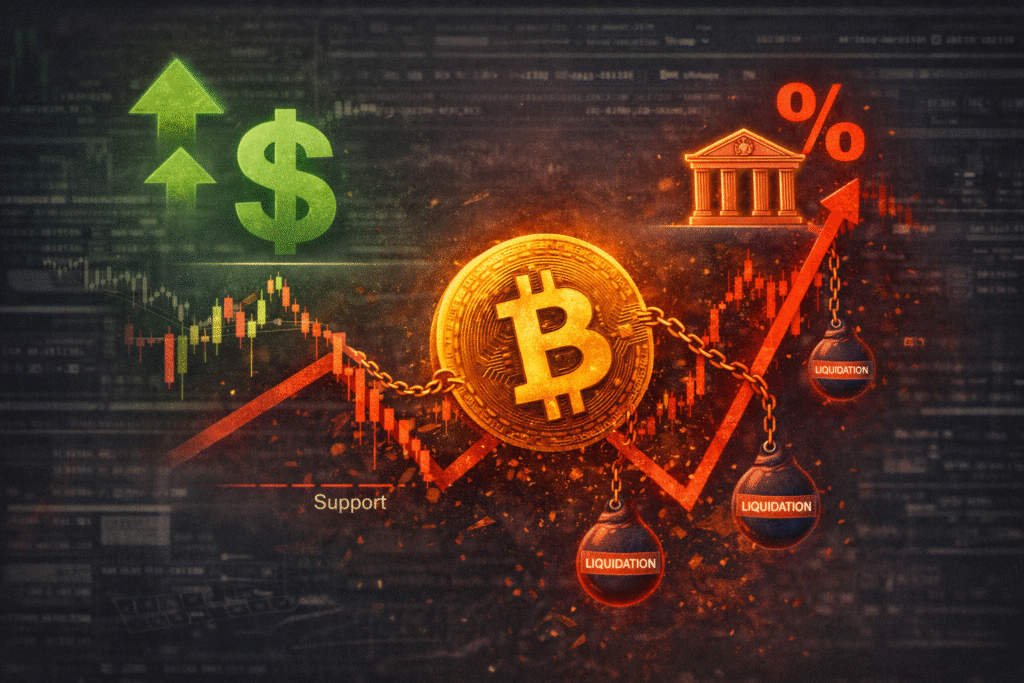

Macro Economic Pressure Played a Big Role

Bitcoin does not live in isolation. Global markets heavily influence their short-term direction.

Interest Rate Expectations Shifted

Around mid-December, investors reassessed expectations around interest rate cuts. When markets believe rate cuts may be delayed, risk assets suffer — and Bitcoin is still treated as a high-risk asset.

Higher interest rates mean:

- Stronger US dollar

- Less cheap money

- Reduced speculative appetite

This shift alone can push Bitcoin down, even without crypto-specific news.

Also read Solana meme coin December 2025 Smart Pick.

Strong Dollar Index Impact

A rising US Dollar Index often puts pressure on Bitcoin. On December 16, the dollar showed strength, which historically creates headwinds for crypto prices.

This inverse relationship has been observed repeatedly, including during previous market pullbacks.

Over-Leveraged Positions Triggered a Cascade

One of the biggest reasons for the sudden crash was excessive leverage.

Liquidation Chain Reaction

Before the drop:

- Funding rates were elevated.

- Long positions dominated the market.

- Open interest remained high.

This is dangerous.

When the price drops slightly in such conditions, exchanges automatically liquidate positions. That selling pushes price lower, causing more liquidations — a domino effect.

I am monitoring the market closely. According to data from platforms like Coinglass, millions worth of long positions were wiped out within hours.

Leverage never forgives greed.

Profit Booking by Smart Money

Retail traders often forget one simple truth: someone must sell for you to buy.

After a strong rally, large holders and institutional players often:

- Lock profits

- Reduce exposure

- Wait for better re-entry levels.

This is not manipulation. It is risk management.

Smart money sells into strength, not fear.

Market Sentiment Shifted Suddenly on 16 December

Crypto markets run heavily on emotion.

Fear Replaced Greed

Just days before the drop:

- Social media sentiment was overly bullish.

- Price predictions became unrealistic.

- Retail confidence peaked

Historically, extreme optimism signals local tops.

When the price started falling, fear spread faster than logic. Many traders sold simply because others were selling.

Markets don’t fall because of bad news.

They fall because confidence breaks.

Was There Any Negative News Behind the Bitcoin Crash in December?

No single catastrophic news caused the drop.

There was:

- No Bitcoin ban announcement

- No ETF rejection news

- No blockchain failure

This was a technical and macro-driven correction, not a fundamental breakdown.

This distinction matters a lot for long-term investors.

How Institutional Behaviour Influenced the Drop

Institutions trade differently from retail.

They:

- Scale in and out

- Use derivatives for hedging.

- React to macro indicators first.

When institutions reduce exposure, liquidity thins. Thin liquidity makes price moves sharper — both up and down.

December is also a period when funds rebalance portfolios before year-end. Crypto is not immune to this behaviour.

Is This a Bear Market Signal or a Healthy Correction?

This is the most important question.

Market Structure Still Intact

Despite the drop:

- Bitcoin held key higher-timeframe support.

- No major trendline breakdown occurred.

- On-chain data did not show panic selling by long-term holders.

Long-term holders remained calm. That’s a strong signal.

Corrections are normal in Bitcoin. In fact, they are necessary for sustainable growth.

What Retail Investors Should Learn From December 16

If December 16 taught us anything, it’s this:

Risk Management Beats Prediction

- Avoid high leverage

- Don’t chase green candles

- Always define stop-loss

Bitcoin rewards patience, not impulsiveness.

Zoom Out, Not Panic

Short-term charts create stress. Long-term charts create clarity.

If your investment thesis has not changed, a single red day should not scare you.

What Comes Next for Bitcoin?

Short-term volatility will continue. That’s normal.

Bitcoin needs:

- Consolidation

- Liquidity reset

- Emotional cooling

Once leverage is flushed out, the market becomes healthier.

Historically, such shakeouts often precede stronger moves — but only when macro conditions allow it.

No guarantees. Just probabilities.

My Opinion

In my opinion, the December 16 Bitcoin crash was not a failure of Bitcoin — it was a failure of expectations. The market punished impatience, not belief. Every cycle, traders forget that Bitcoin does not move in straight lines. When leverage rises faster than conviction, corrections become unavoidable. What stood out this time was not the fall itself, but the calm behaviour of long-term holders. That silence speaks louder than panic tweets. For serious investors, this drop was not a warning sign — it was a reminder. Bitcoin does not reward those who predict tops and bottoms; it rewards those who respect risk, understand cycles, and stay disciplined when emotions run high.

FAQs

Why did Bitcoin suddenly drop on December 16?

Bitcoin dropped due to a mix of macro uncertainty, high leverage, profit booking, and a shift in market sentiment — not because of any single negative news event.

Was this crash caused by manipulation?

No clear evidence suggests manipulation. The move aligned with typical leverage liquidation patterns and macro-driven risk-off behaviour.

Should investors be worried about a bigger crash?

As of now, long-term market structure remains intact. Corrections like this are common in Bitcoin and do not automatically signal a bear market.

Did institutions sell Bitcoin on December 16?

Institutions likely reduced exposure and rebalanced portfolios, which affected liquidity and price movement.

Is this a good buying opportunity?

That depends on individual risk tolerance. Long-term investors often view such corrections as accumulation zones, while short-term traders should stay cautious.

Final Thoughts

Bitcoin did not crash because it is weak.

It was corrected because markets need balance.

Understanding why Bitcoin crashed on December 16. helps you trade smarter, invest calmer, and avoid emotional decisions. The market rewards those who stay rational when others panic.

Bitcoin has always tested patience before rewarding conviction.

Disclaimer

This content is for informational purposes only and not financial advice. Cryptocurrency investments involve risk. Always do your own research before making any investment decisions.

Muddu – Crypto Enthusiast & Analyst

Muddu has been actively involved in the crypto world for more than 3 years, closely tracking Bitcoin, altcoins, and emerging blockchain projects. With hands-on experience in crypto trading, market analysis, and following global regulations, he simplifies complex crypto trends into easy-to-understand insights for readers.

Through FastCryptoBuzz, Muddu aims to bring honest, research-driven, and timely crypto updates that help readers stay ahead in the fast-moving digital asset space. His mission is to make crypto knowledge accessible to everyone – from beginners to seasoned investors.

“Crypto is not just about coins, it’s about building the future of finance.” – Muddu